Former US President and Republican presidential candidate Donald Trump raised $12 million at a fundraiser in San Francisco attended by prominent cryptocurrency leaders. "Trump said he would be the cry... View MoreFormer US President and Republican presidential candidate Donald Trump raised $12 million at a fundraiser in San Francisco attended by prominent cryptocurrency leaders. "Trump said he would be the crypto president," a tech executive said at the event.

Trump Raises Money in Silicon Valley

Trump prefers Silicon Valley as a source of campaign funds. According to Reuters, Trump raised $12 million at an event held at the home of tech entrepreneur David Sacks in San Francisco. The event was hosted by Social Capital CEO Chamath Palihapitiya.

Cryptocurrency Adoption Accelerates

Ahead of the 2024 election, Trump's interest in cryptocurrencies has grown. Famous cryptocurrency leaders such as Gemini founders Cameron and Tyler Winklevoss also attended the event. Trevor Traina, COO of Tools for Humanity, said Trump pledged to be the "crypto president" at the event. Jacob Helberg, an advisor to Palantir Technologies, said the anti-crypto policies of the Trump Biden-Gensler administration will end in a second Trump administration.

Growing interest among crypto supporters

Harmeet Dhillon, a member of the Republican National Committee, said Trump did not provide details about his cryptocurrency policy. However, crypto supporters continue to support Trump in the upcoming elections. Intercom CEO Eoghan McCabe explained on social media platform X that many of the people he interviewed at the event had voted or donated to the Democratic Party in the past but now support Trump. He emphasized that these elections are a referendum on war and immigration policies.

Support for cryptocurrencies is growing

Trump announced his support for cryptocurrencies in May and announced that he would accept Bitcoin, Ethereum, Solana, Dogecoin, and Shiba Inu cryptocurrencies for his campaign. At the Libertarian Convention, he said he would commute the sentence of Silk Road founder Ross Ulbricht, stop the creation of a central bank digital currency (CBDC) in the United States, and support self-custody.

Biden's Crypto Strategy

President Joe Biden's reelection campaign has also begun to seek guidance from crypto industry players on crypto communities and policies.

Trump's interest in cryptocurrencies and his fundraising activities in Silicon Valley have attracted attention ahead of the 2024 election. The crypto world is closely watching Trump’s promises and policies.

U.S. Treasury yields have risen sharply in the past few weeks, with the benchmark 10-year Treasury yield breaking through 4.3% as of August 21. "This is the highest level since 2007. And pointed out t... View MoreU.S. Treasury yields have risen sharply in the past few weeks, with the benchmark 10-year Treasury yield breaking through 4.3% as of August 21. "This is the highest level since 2007. And pointed out that the sharp rise in U.S. Treasury yields occurred mainly at the longer end of the Treasury yield curve. U.S. Treasury short-term yields remained relatively stable in August 2023.

The sell-off in U.S. Treasury bonds was not driven by the latest U.S. inflation data, as recent reports showed a significant slowdown in U.S. consumer price increases. "In fact, actual inflation looks like it has fallen below the Federal Reserve's (Fed) June 2023 forecast.

The sell-off may not be attributed to any changes in market expectations about the future path of U.S. interest rates.

So, what should the sharp rise in U.S. Treasury yields be attributed to? It is believed that there are three factors at work. First, because the U.S. economy is more resilient than expected in the current high-interest rate environment, some investors are re-adjusting the equilibrium or neutral interest rate for the next five to ten years.

The neutral interest rate is the interest rate at which monetary policy neither accelerates nor slows economic growth. "Recently, the US market has raised the neutral rate to close to 4%, which is the highest level in a long time. I think this is the first factor driving the rise in US Treasury yields."

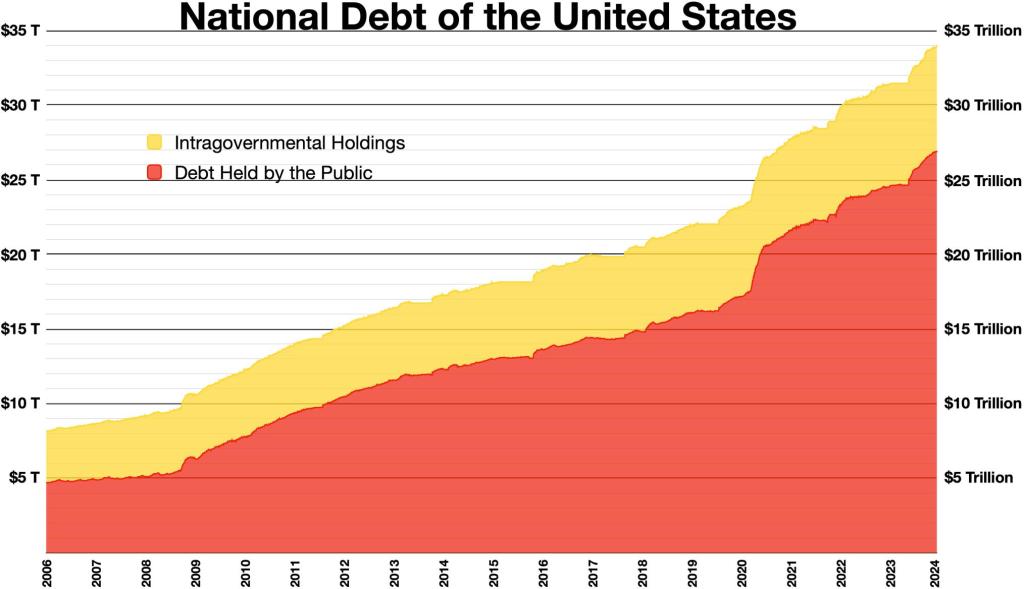

The second potential driver is the increase in US Treasury issuance, which has changed the supply dynamics within the US Treasury market and surprised some investors. "The increase in Treasury issuance may lead to demand for higher Treasury yields."

The last factor driving the rise in US Treasury yields may be some global factors. In particular, the Bank of Japan's announcement on July 28, 2023 that it will relax its control of the 10-year Treasury yield curve may have played a role. "For quite a long time, Japan has been the anchor point for global yields, helping to keep yields down. Now, the anchor point for global yields has moved up, which may also lead to higher US Treasury yields.

For investors, a key point behind the rise in US Treasury yields is that the fixed income market looks increasingly attractive. If the US economic conditions deteriorate, the US will continue to inflate inflation.

More and more countries are selling US Treasury bonds, which is unexpected for the Fed.

The cryptocurrency market is going through a nervous period right now as price action has been poor over the past few weeks. However, on a more macro level, altcoins are still looking very bullish. Is... View MoreThe cryptocurrency market is going through a nervous period right now as price action has been poor over the past few weeks. However, on a more macro level, altcoins are still looking very bullish. Is the bull run just forming?

Typical altcoin volatility

With the ups and downs of the current bull run, many altcoin investors may be nervously watching their holdings and may even be considering selling as some of their altcoins have plummeted by over 40% in the recent reversal.

That being said, one could argue that unless you are a trader, it is best to research the most promising altcoins first and invest in them over the next year or so. If the bull run is anything like the previous ones, it will float most boats, it is just a case of trying to ignore the huge volatility that is common to this asset class.

Altcoins within the bull pennant MC

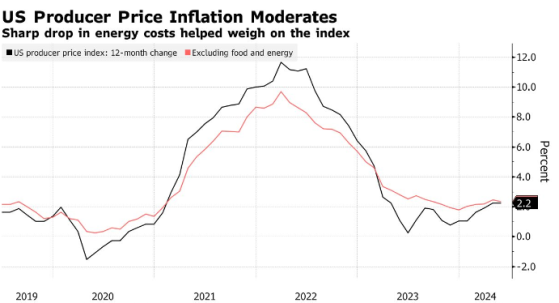

Zhitong Finance learned that the U.S. producer price index (PPI) unexpectedly fell in May, the largest drop in seven months, which seems to further prove that U.S. inflation pressure is easing. Data r... View MoreZhitong Finance learned that the U.S. producer price index (PPI) unexpectedly fell in May, the largest drop in seven months, which seems to further prove that U.S. inflation pressure is easing. Data released by the U.S. Bureau of Labor Statistics on Thursday showed that the U.S. PPI annual rate in May was 2.2%, lower than the expected 2.50% and the previous value of 2.20%. The U.S. PPI monthly rate in May was -0.2%, expected to be 0.10%, and the previous value was 0.50%.

Nearly 60% of the decline in the commodity PPI in May was due to falling gasoline prices. Diesel, commercial electricity and aviation fuel prices also fell. Commodity prices fell 0.8% overall, the largest drop since October last year. But service costs remained unchanged.

Several categories in the PPI report used to calculate the Federal Reserve's preferred inflation measure (PCE price index) showed signs of cooling inflation in May. Among them, air ticket prices fell 4.3%, and portfolio management service prices fell 1.8%. Doctors' care costs remained flat, and hospital outpatient costs rose 0.5%. The PCE price index for May will be released later this month.

Excluding food, energy and trade services, the core PPI index was flat in May, the mildest in a year, with expectations for a 0.3% increase and a previous value of 0.5%. The cost of processed products for intermediate demand, which reflects prices early in the production pipeline, fell 1.5%, the biggest drop since the end of 2022. This reflects a sharp drop in energy costs.

The U.S. producer price index unexpectedly fell in May due to lower energy costs, another sign that inflation is retreating after a surge in the first quarter. Before the release of the PPI report, the previous CPI data in May also showed a general cooling of the economy. The previous cooling of CPI data across the board boosted financial market hopes that the Federal Reserve will start cutting interest rates in September. Since July last year, Fed officials have kept the benchmark interest rate at its highest level in more than 20 years. The Fed's dot plot on Wednesday showed that they expect only one rate cut this year while waiting for further progress on inflation.

Another report released at the same time on Thursday showed signs of a cooling in the U.S. job market - the number of initial jobless claims rose to the highest level since August last week. The number of initial jobless claims in the United States for the week ending June 8 was 242,000, the highest since the week ending August 12, 2023.

After the release of these two data, U.S. Treasury yields fell; the 10-year yield fell 3.00 basis points to 4.266%. Major stock index futures rose. Spot gold rose by more than $10 in the short term and is now at $2,316.19 per ounce. The U.S. dollar index DXY fell nearly 30 points in the short term and is now at 104.66.

As of local time on the 4th, the election for the Speaker of the U.S. House of Representatives has been held for six rounds, but no candidate has received enough votes, and the election deadlock will ... View MoreAs of local time on the 4th, the election for the Speaker of the U.S. House of Representatives has been held for six rounds, but no candidate has received enough votes, and the election deadlock will continue. The Speaker of the House of Representatives continues to be "difficult to give birth", and the new Congress members cannot take office, and the farce of division in the American political arena is getting more and more intense.

As a political stronghold in the United States and a symbol of so-called American democracy, Capitol Hill should be one of the key forces leading the progress of American society. However, the endless farces and scandals have made Capitol Hill itself a problem in American politics. The last time the Speaker of the House of Representatives was "difficult to give birth" was in 1923, a hundred years ago, when the members of the House of Representatives voted for a total of nine rounds before selecting the Speaker. The reappearance of the "unprecedented" scene reflects that the increasingly polarized party struggles and intra-party political divisions have put the American system into a "vicious circle."

page=1&profile_user_id=139024&year=&month=

Load More