Entertainment

Be the first person to like this.

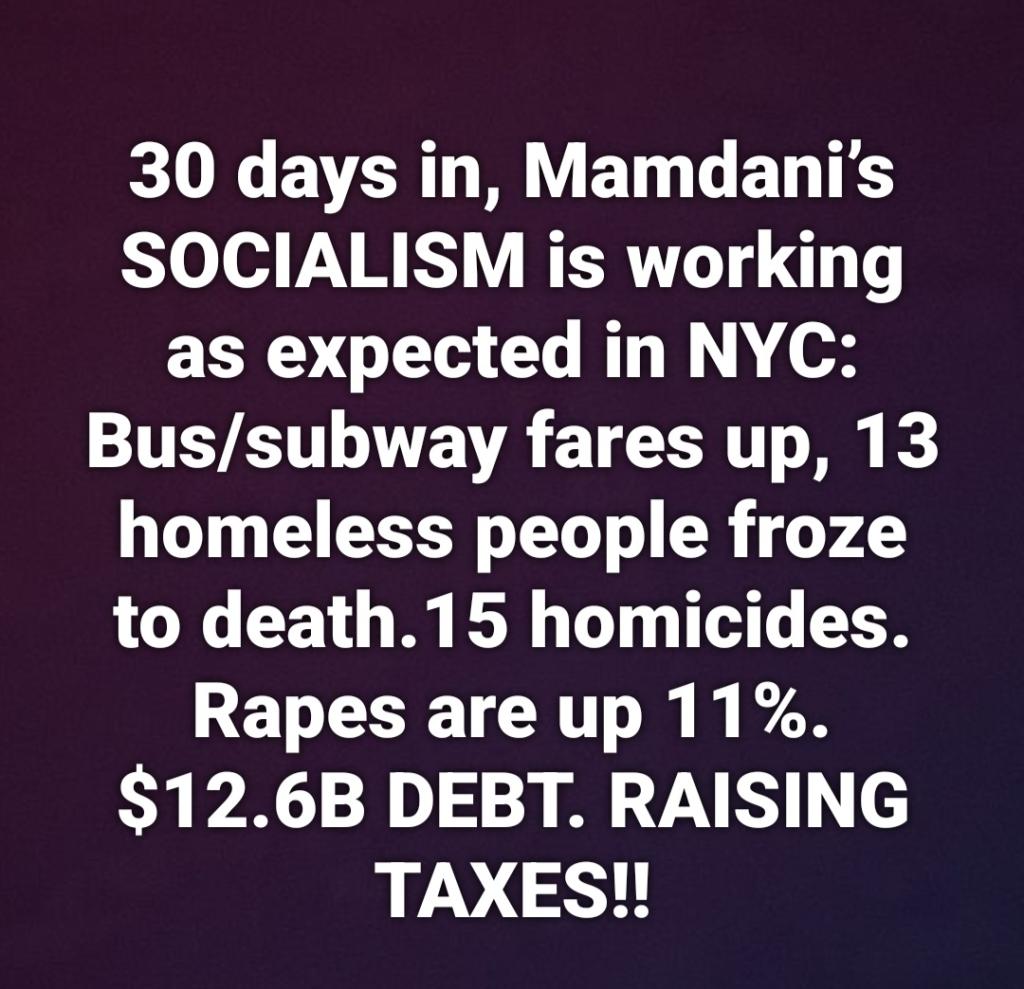

Now, more than ever, I'm glad I pulled all my monies out of the NYC account I had. Money now sits safely out of his reach here in GA...

Im pulling every cent of mine before the midterms. We need fucking arrest and accountability before the midterms.

Be the first person to like this.

Be the first person to like this.